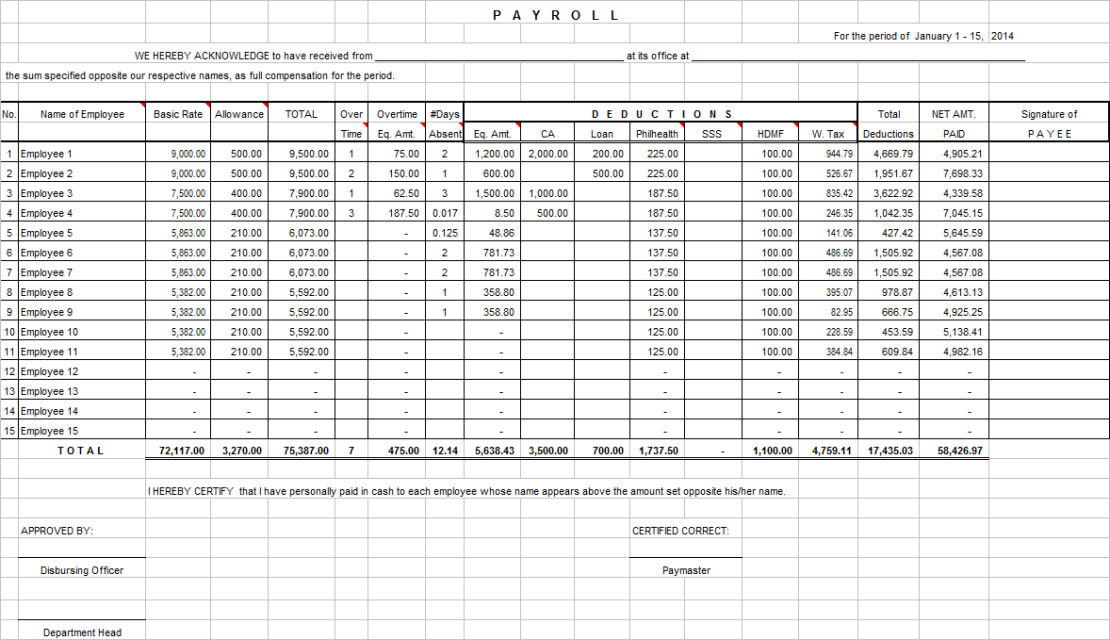

Social Security tax is set to automatically calculate if you enter the employee’s name and pay rate information correctly. This is where you should always start when making changes, because all of the remaining payroll tabs pull their source data from here. Go to the “Set Up Employee Data” tab first. If you live in a locality, like New York City (NYC), that charges local income tax, you will need to reflect it in the template. How many employees do you have? What benefit payments and deductions do you need to withhold from their paychecks? Is there anything missing from the template that you need to add? Add or Delete Columns First, take a look at the template, and evaluate your business needs. Review Payroll Excel Template & Edit for Your Businessįiguring out how to do payroll using an Excel template can take some time on the front-end.

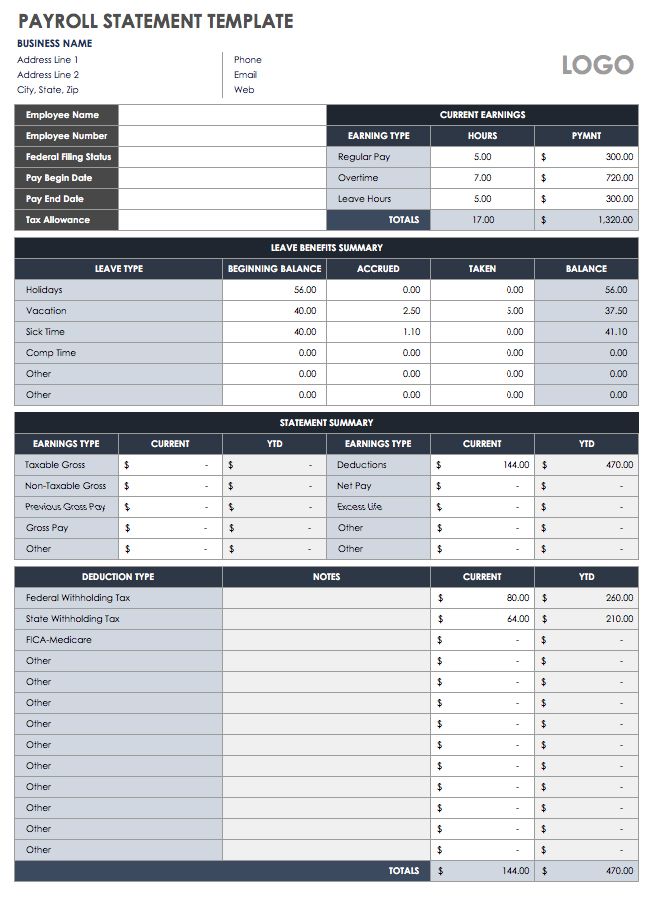

Here are the steps you need to follow when using our free Excel payroll template to do your business’ payroll: 1. Then you’ll enter hours worked, and watch your payroll information automatically populate. First, you’ll enter the information that doesn’t vary often, such as employee names, pay rates, tax rates, and deductions. We’ve created an Excel template for you, and it has 15 tabs, one for each month, employee data setup, employer tax information, and year-end payroll information.

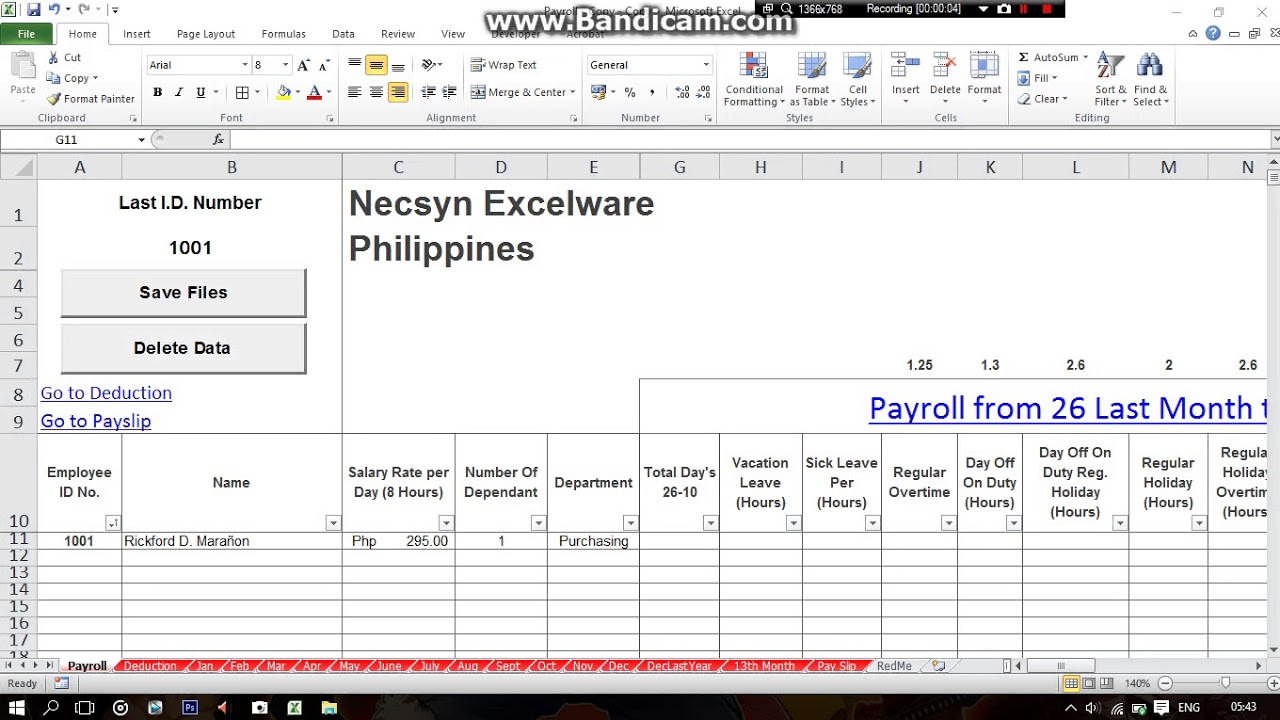

You should also have a setup tab so your payroll calculations can pull standard information like pay rate and benefits enrolled keeping this updated so you can link to it each month helps automation and prevents duplicate work. There should be tabs for each month linked with formulas that calculate and sum employees’ taxes, deductions, and pay. Running payroll in Excel efficiently requires a standardized payroll Excel template you can use from month to month. Visit When I Work How Doing Payroll in Excel Works You can schedule time for up to 10 days in advance and forecast upcoming wage expenses using the new budget tool. If you need help scheduling and tracking your employees’ hours worked, consider When I Work.

Automation helps streamline payroll, whether you use a template or payroll provider. To save time, use a payroll Excel template with prefilled information, like tax rates and overtime formulas. Doing payroll in Excel is best for businesses that need to pay 10 or fewer employees and operate in states without complex labor and tax laws.

0 kommentar(er)

0 kommentar(er)